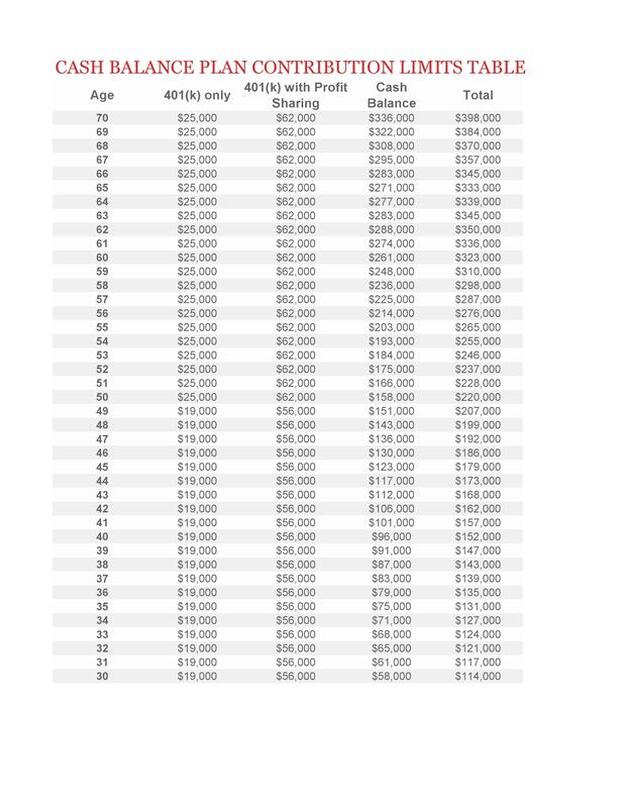

Multiply retirement savings: Doubled or even quadrupled annual retirement plan savings are possible. A 401(k) plan allows contributions of up to $19,000 per year plus an extra $6,000 per year “catch up” for individuals 50 years old and over. Profit sharing allows up to an additional $37,000 for a total of $62,000 per year. A cash balance plan allows an extra $55,000 to $336,000 of deductible savings.

|

|

Savings rate may be the single most important variable in the accumulation of wealth! - Nick Murray

Orchid will work with you and an actuary to provide a plan illustration and show you what type of savings is possible to you and your participants. |

We can help you and you participants accelerate your retirment savings. This will to ensure an ontime retirement with plenty of money to support your lifestyle.

|

Reach your retirement goals on time! |

|

Attract and retain employees: Cash balance plans are very attractive to current and future partners and employees. When a cash balance plan is implemented, retirement plan participation improves.

|

Here's what to do first!

1. Call Seth at (650) 334-6104 to get started!

2. Schedule a phone or in person free consultation that will take about 20-30 minutes. 3. The focus will be on discovering your goals. 4. We will work with an actuary and provide your with a sample illustration. 5. The goal is to implement a new plan! 6. Some of the PERKS with Orchid is the ongoing guidance and service to participants. 7. Give your team the best and schedule an appointment TODAY! |